Cash Flow

Financial statement that shows the inflows and outflows of cash for a company over a specific period of time. Cash flow statements are used to assess a company's liquidity, solvency, and overall financial health.

Benefits:

-

Assessing liquidity: The cash flow statement helps to assess a company's liquidity, which is its ability to meet its short-term obligations.

-

Evaluating solvency: The cash flow statement also helps to evaluate a company's solvency, which is its ability to meet its long-term obligations.

-

Understanding financial performance: The cash flow statement provides a comprehensive picture of a company's financial performance, including its ability to generate cash from operations, invest in growth, and meet its financial obligations.

-

Making informed decisions: The cash flow statement can be used to make informed decisions about a company's operations, investments, and financing.

Cash Flow Statement

Classic Cash Flow Statement format.

Key metrics at a glance:

-

Actual: This column shows the actual amount (Net Income Amount) of cash inflow or outflow for the item.

Mapping & Filtering

Selection Page:

-

From Fiscal Period

-

To Fiscal Period

-

Branch

-

Ledger

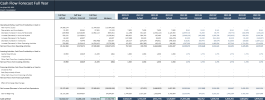

Cash Flow Forecast

Cash Flow Statement for a full year including forecast.

Key metrics at a glance:

-

Full Year Actual: This column shows the actual cash flows (Net Income Amount) that have occurred for the entire year.

-

Full Year Actual + Forecast: This column shows the actual cash flows + forecasted amounts for the entire year.

-

Full Year Forecast: This column shows the projected cash flows (Budget Net Income) for the entire year.

-

Variance: This column calculates the difference between the actual and forecasted cash flows.

Mapping & Filtering

Selection Page:

-

Fiscal Period

-

Branch

-

Ledger

-

Budget Ledger