(FR) Balance de vérification

The Balance de vérification is a financial accounting worksheet used to ensure the debits and credits for all general ledger accounts balance.

Benefits:

-

Error detection: The main purpose of a balance de vérification is to help identify errors in the accounting system. Because the total debits and credits must balance, any errors will cause the trial balance to be out of balance. This can help accountants identify and fix mistakes before they cause problems with the financial statements.

-

Preparation of financial statements: The balance de vérification is used as a starting point for the preparation of financial statements, such as the income statement and balance sheet. By ensuring that the trial balance is balanced, accountants can be confident that the financial statements are accurate.

-

Improved financial accuracy: By using a balance de vérification, accountants can help to ensure that the company's financial records are accurate and up-to-date. This is important for a variety of reasons, such as complying with tax regulations and making sound business decisions.

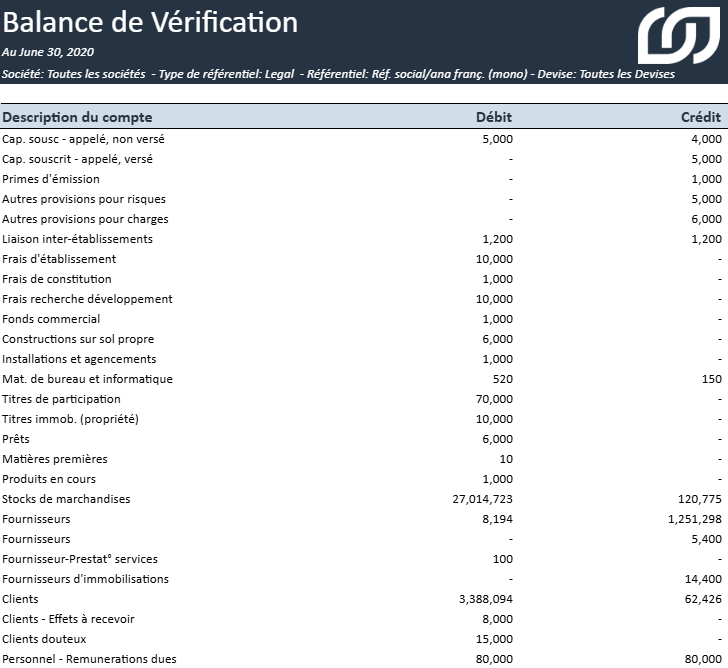

Balance de vérification

Classic balance de vérification format.

Key Metrics at a Glance:

-

Débit: This column shows the total debits for each account. A debit typically represents an increase in an asset or expense account, or a decrease in a liability or equity account.

-

Crédit: This column shows the total credits for each account. A credit typically represents a decrease in an asset or expense account, or an increase in a liability or equity account.

Mapping & Filtering

Selection Page:

-

Société

-

Année

-

Période fiscal

-

Type de référentiel

-

Référentiel

-

Budget

-

Devise

-

Mapped Dimension 1

-

Mapped Dimension 2

-

Mapped Dimension 3

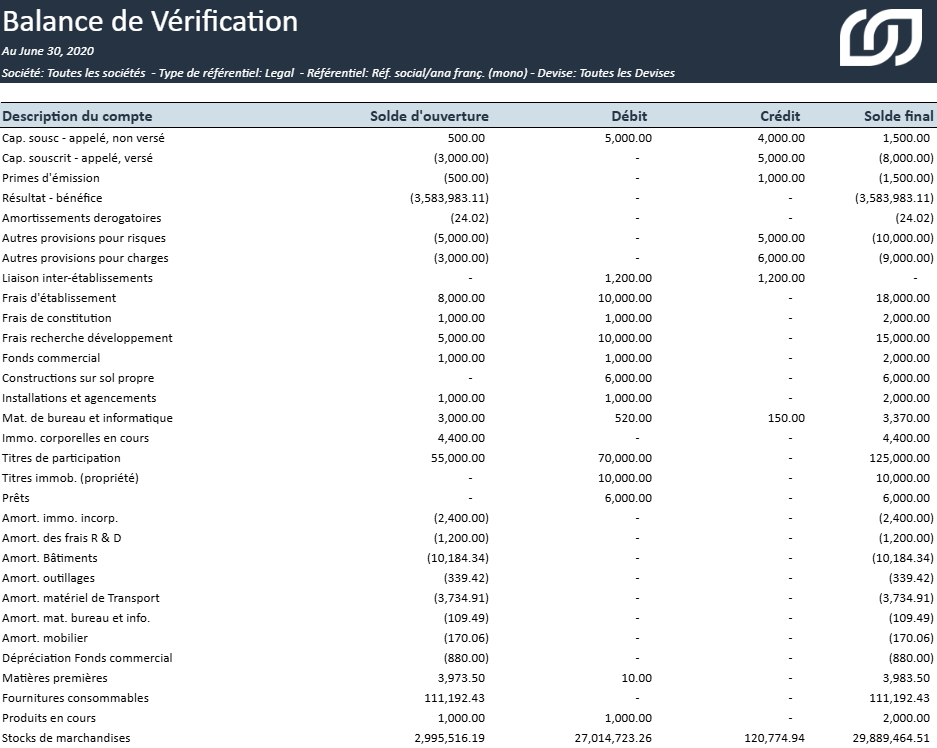

Balance de vérification V2

Balance de vérification with Opening/Closing Balance and Period to Date Debit/Credit.

Key Metrics at a Glance:

-

Solde d'ouverture: This column shows the balance of the account at the beginning of the accounting period for which the balance de vérification is prepared.

-

Débit: This column shows the total debits posted to the account for the period. A debit typically represents an increase in an asset or expense account, or a decrease in a liability or equity account

-

Ptd Crédit: This column shows the total credits posted to the account for the period. A credit typically represents a decrease in an asset or expense account, or an increase in a liability or equity account.

-

Solde final: This column is calculated by adding the beginning balance to the debits and subtracting the credits. It represents the balance of the account at the end of the accounting period.

Mapping & Filtering

Selection Page:

-

Société

-

Année

-

Période fiscal

-

Type de référentiel

-

Référentiel

-

Budgt

-

Devise

-

Mapped Dimension 1

-

Mapped Dimension 2

-

Mapped Dimension 3